The Finance Director's 90-Day Plan to Control AI Spending

95% of AI Projects Fail. Yours Does Not Have to.

Here is the scene: A vendor arrives with a £250k AI proposal. Marketing is excited. IT talks features. Your board says "proceed."

You are thinking: Will this actually pay back?

Most CFOs cannot answer that question. Here is why: 95% of enterprise AI initiatives deliver no measurable return (MIT, 2025). 56% of CEOs report zero ROI in the last year (PwC, 2026). Meanwhile, 71% of UK employees are using unapproved AI tools—half of them weekly, few disclosing it to managers (Microsoft UK, 2025).

The problem is not the technology. It is governance. AI projects are treated as IT experiments, not capital investments. No one tracks the money. No one owns the outcome.

You would never approve a £250k ERP system without monthly implementation reports. Why would you approve AI projects without them?

You already know how to govern major projects. You track payback on ERP implementations. You review variance reports on cloud migrations. You monitor go-live risks on system upgrades.

What AI Delivers

Done right, AI delivers three measurable outcomes:

Growth. AI can identify which customers are about to churn, which prospects are most likely to convert, and where pricing can be optimised. Mid-market companies are seeing 8-15% improvement in win rates and retention when AI is deployed with discipline.

Automation. Invoice processing that takes 5 days drops to 1. Forecasting accuracy improves by 10-20 percentage points. Customer service responses happen in minutes, not hours. These are not theoretical—they are happening now in businesses like yours.

Scale. The same AI model that automates AP can be reused for expenses, supplier onboarding, and contract review. Once you build the governance to deploy one tool well, you can roll out five more in half the time.

The risk is real. But so is the upside. The playbook below helps you capture the upside while managing the risk.

What This Will Cost You If You Wait

44% of UK businesses have already suffered data exposure from shadow AI (SAP, 2025). Compliance officers are losing sleep. Auditors are asking uncomfortable questions.

Meanwhile, costs creep up in the background. Licenses renew. Token usage explodes. Integration projects lag. No one is watching. No one owns it.

And the results? In most organisations, they are invisible.

You cannot govern what you cannot see. That is Step 1.

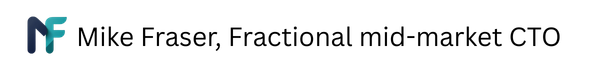

Step 1: Run a 30-Day AI Inventory

Goal: Know where AI is used, before it bites you.

Ask for one page with five columns:

- Tool name (ChatGPT, Copilot, niche SaaS with AI features)

- Who uses it (team, rough number of users)

- What for (which process or decision)

- What data goes in (customer, personal, financial, confidential, none)

- Risk notes (e.g. "customer data to US-hosted tool", "used for regulatory reports")

Who does the work? Nominate one project lead from Finance or Operations. Give them a small working group: one from IT, one from HR, one from Risk/Compliance (if you have one). Time-box it: 30 days, then stop.

You are not trying to ban everything. You are trying to stop being blind.

Step 1 tells you WHERE the AI risk is. The inventory identifies every tool, every user, every data flow. It is your starting point.

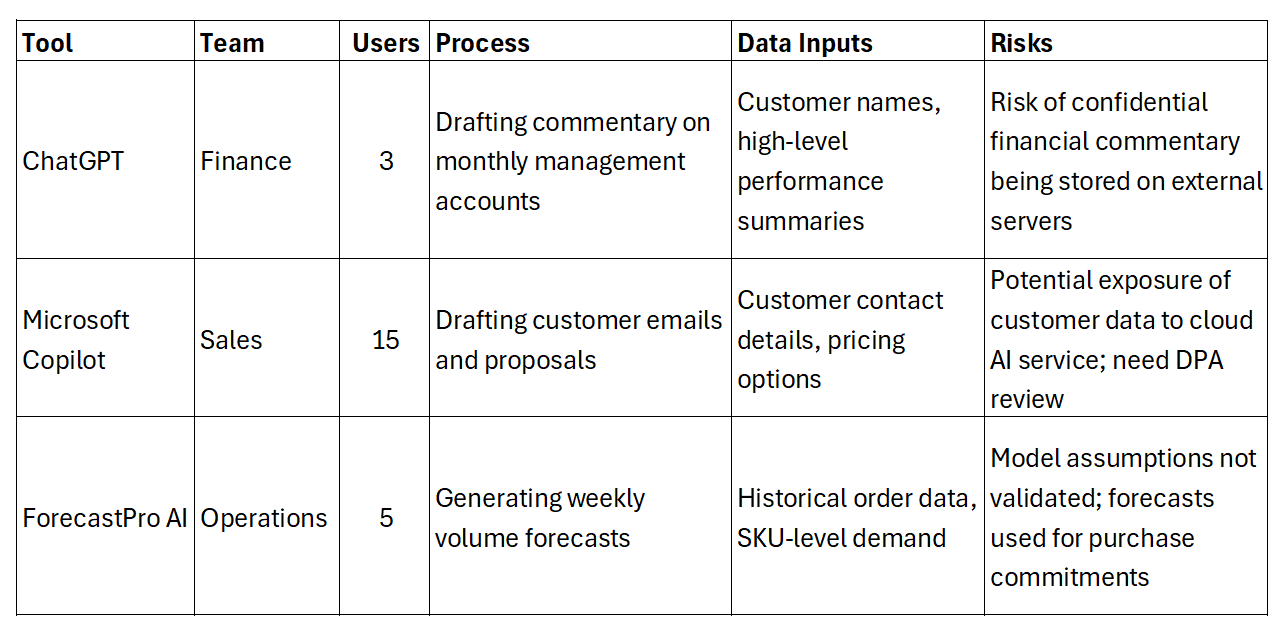

Step 2: Set a Simple Investment Gate

From now on, any AI proposal over a threshold you choose (say £50k per year) passes a three-question test before it reaches the Board.

Ask the sponsor for one page that answers:

Problem. What are you fixing, in numbers? "Reduce invoice cycle from 5 days to 1." "Improve forecast accuracy by 15%." "Cut customer churn by 8%."

Baseline. What does the process cost today? People, time, errors, write-offs, lost revenue. If they cannot quantify the current pain, do not approve the cure.

Impact in pounds. Net annual benefit once live (savings plus revenue minus running costs). Include cloud costs, token usage, integration, support, and licence creep. Include one-off implementation cost and payback period.

If a proposal cannot clear this bar on one page, it is not ready. This is how you buy Cloud and ERP systems. AI should be no different.

Who runs this gate? You own the template and sign off the numbers. The Board needs to commit publicly: "No AI spend without these three answers."

Step 2 stops NEW risks from entering. The investment gate blocks poorly-defined projects before they consume budget. It forces sponsors to think like investment stewards, not technology evangelists.

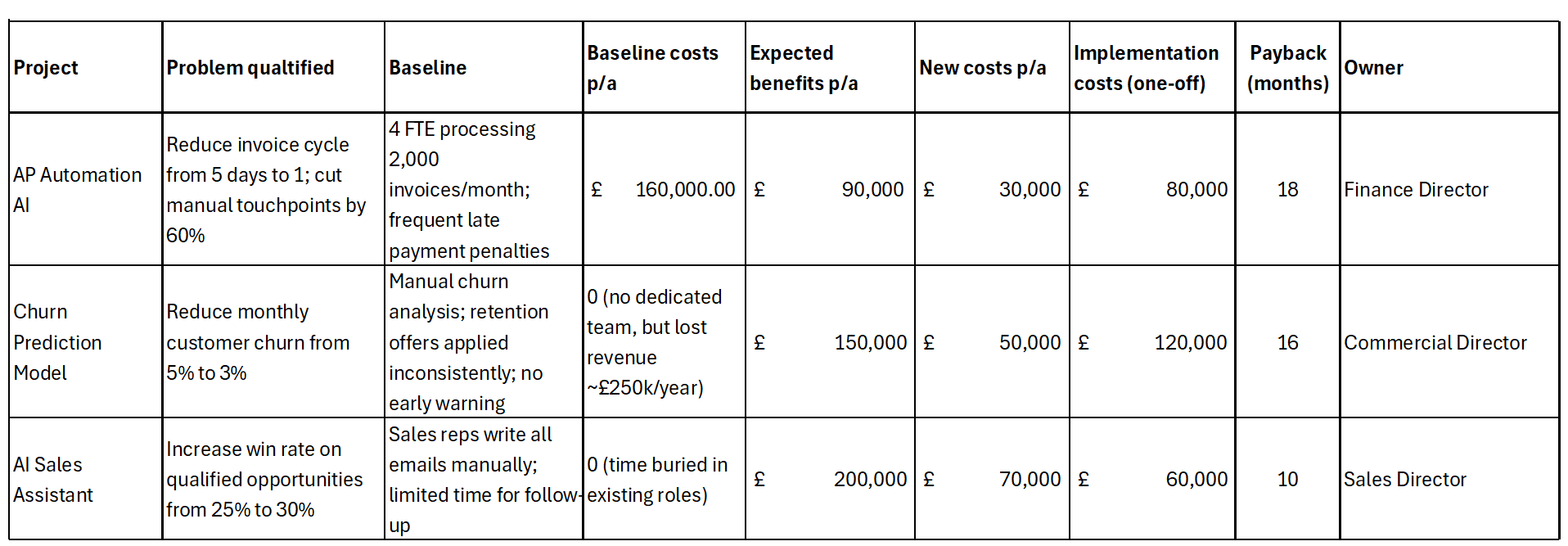

Step 3: Name Three Owners for Every Project

You do not need a new committee. You do need clear names against key roles.

For each significant AI tool or project, you want three owners:

Business Owner. Usually a functional director. Accountable for the result and for stopping the project if it does not deliver.

Data Owner. Knows what "good data" means in your business. Often someone in Finance, Operations, or a data lead. Accountable for data going in and coming out: quality, sourcing, retention.

Risk/Compliance Owner. Can be your existing Risk, Compliance, or even Head of IT role. Checks for issues with ICO, FCA or sector rules, customer commitments, and your own policies.

Write these names down. Put them in the Board pack for any major AI initiative. Ambiguity is where shadow AI thrives.

Who sets this up? You set the rule: no major AI project without three named owners. Your Company Secretary makes sure it appears in the monthly Board reports.

Step 3 assigns accountability. Named owners mean your Step 1 inventory and Step 2 gate actually get enforced. Without names, governance is just paperwork.

Step 4: Track Monthly, Not Annually

You would not approve a £250k system upgrade and never check delivery milestones. Treat AI the same way.

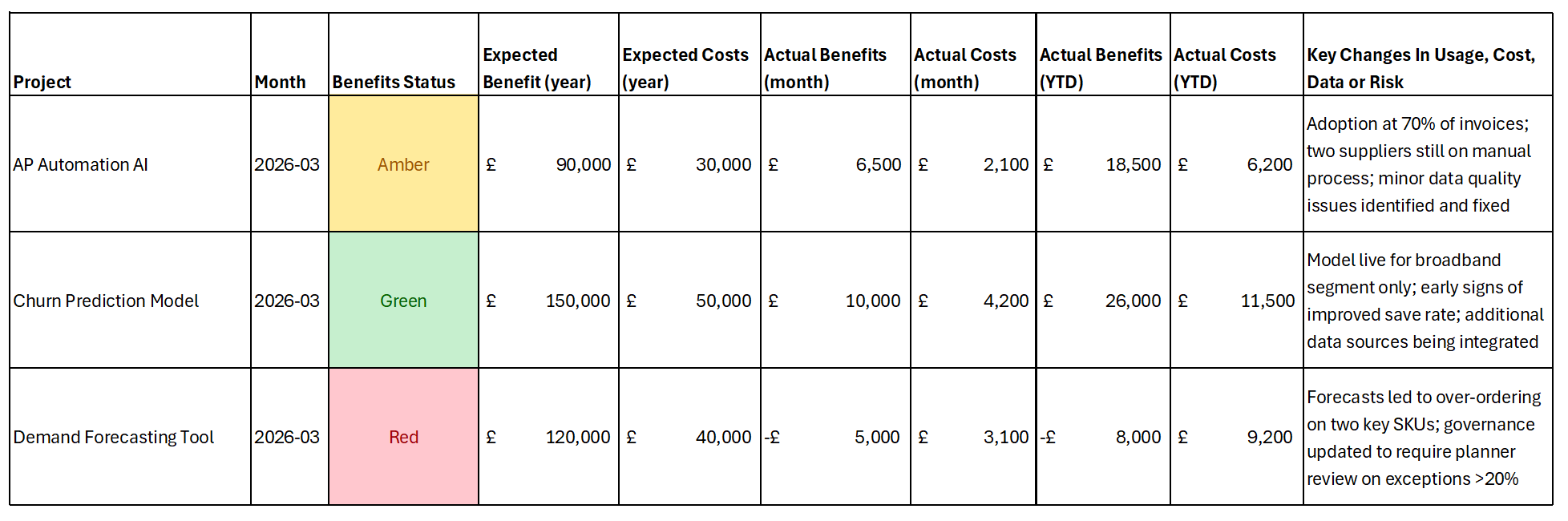

For each sizeable AI initiative, ask for a short monthly line in your management report:

- What we expected (benefit and cost, in pounds)

- What we see so far (month and year-to-date)

- Any change in usage, cost, data, or risk

- One clear RAG status (red / amber / green)

If nothing is measured, assume the benefit is zero and the risk is rising.

Who writes this? The Business Owner writes the short commentary. Finance checks the numbers. You read it and ask: "If this were an underperforming sales territory, what would we do?"

Step 4 proves it is working. Monthly tracking shows whether your three previous steps are preventing failure or just creating paperwork.

What This Looks Like in Practice

Here is what happens when you run this playbook:

The 30-day inventory exposes shadow AI. Most mid-market companies find 15-25 tools in use. A significant percentage process customer data through unapproved platforms.

The investment gate kills poorly-justified projects before they start. Companies typically stop 2-4 proposals that cannot answer the three questions. Each can represent £50k-£150k in avoided waste.

Monthly tracking creates accountability. When Finance Directors add one page to the Board pack, spending becomes visible. Visibility creates discipline.

What to Say to Your Board and Investors

You do not need a long speech. You need one clear line that sets direction.

You can say: "We will treat AI like any other material investment decision: clear problem, hard numbers, named owners, and monthly tracking. That is how we will get value and stay on the right side of the ICO, the FCA, our customers and our colleagues."

This does three things: Reassures the Board you are not anti-AI. Signals to investors, staff and customers that you care about ROI, not fashion. Gives IT and the business a simple frame to work within.

What This Costs – and Why It Is Worth It

You will need:

- A small amount of your time to run the inventory and set the gate

- A bit more discipline from sponsors when they write proposals

- One page added to your monthly Board pack

In return, you reduce the chance of:

- Paying for AI projects that never pay back

- Explaining to auditors why customer data sat in an unapproved US-hosted tool

- Discovering that your forecasts were driven by an untested model someone found on Reddit

You also make it easier to say "yes" to the right projects, because they come with clear economics and clear owners.

If You Do Nothing

AI will still spread through your business.

Shadow AI will grow. Costs will creep up. Risks will accumulate. Some projects will work, but you will not know which ones or why.

Worse: you will miss the compounding advantage. When Finance automates invoice processing with discipline, Operations can reuse that same approach for purchase orders. When Sales builds a lead-scoring model that works, Marketing can apply it to campaigns. Governance creates the scaffolding for scale.

Without it, every department builds in isolation. Lessons are not shared. Wins are not repeated. Costs multiply.

As FD, you will still own the outcome. The only question is whether you own it by design or by accident.

How to Implement This in 90 Days

Four moves in 90 days:

- Inventory

- Investment gate

- Named owners

- Monthly tracking

Option 1: Do it yourself.

Download the free spreadsheet below. Run your inventory. Train your Financial Controller on the investment gate. This works if you have spare bandwidth and a compliant IT team.

Option 2: Do it with me.

I will deliver three things: a complete AI inventory with risk flagging, a board-ready investment gate your team can use immediately, and 90-day implementation with your team trained on the method. You get governance that sticks, not a consultant report you file and forget.

I am building this practice now. The framework comes from 15 years helping mid-market companies govern technology investments. The four-step method has worked in every business where discipline beats dashboards.

If you want Option 2, book a 30-minute scoping call. I will walk you through exactly how I would run your 90-day implementation.

Not ready to commit 30 minutes?

Send me your toughest AI investment question: hello@mikefraser.me. I will answer it within 48 hours. No charge. No follow-up unless you ask for one.

Sources

- MIT: 95% of AI pilots fail to deliver ROI (2025)

- PwC: 56% of CEOs report zero ROI from AI (2026)

- Microsoft UK: 71% of UK employees use unapproved AI tools (2025)

- SAP: 44% of UK businesses have suffered shadow AI data exposure (2025)

- Gartner: How CFOs can maximize ROI from AI

- Financial Times: Rise in shadow AI tools raising security concerns for UK